Southwest Credit Card for Business: Are you a business owner looking for a reliable credit card that offers great benefits and rewards? Look no further! In this comprehensive guide, we will explore the process of applying for a Southwest credit card designed specifically for businesses.

Southwest Airlines is known for its excellent customer service and travel perks, and their business credit card is no exception. By the end of this article, you’ll have a thorough understanding of the application process and the advantages of obtaining a Southwest business credit card. Southwest Credit Card for Business

The Southwest Rapid Rewards credit card is a popular choice for both personal and business use, offering numerous benefits and rewards for frequent flyers. If you own a business and frequently travel with Southwest Airlines, getting a Southwest credit card for your business can provide you with a range of advantages. This article will guide you through the process of applying for a Southwest credit card for your business, ensuring you make the most of its benefits.

Benefits of a Southwest Credit Card for Business

Earn Rapid Rewards Points

As a business owner, maximizing your rewards is crucial. The Southwest business credit card allows you to earn Rapid Rewards points on every purchase you make. These points can be redeemed for flights, hotel stays, car rentals, and more. By strategically using your credit card for business expenses, you can accumulate a significant number of points and enjoy fantastic travel rewards.

Companion Pass

One of the standout benefits of a Southwest credit card for business is the potential to earn a Companion Pass. A Companion Pass allows you to designate a companion who can fly with you for free on both paid and reward flights. Earning a Companion Pass requires meeting certain requirements, such as earning a specified number of Rapid Rewards points within a calendar year. Having a Companion Pass can significantly reduce your business travel expenses.

Exclusive Business Benefits

In addition to the general benefits offered by Southwest credit cards, the business version provides exclusive perks tailored to business owners. These perks may include bonus points for business-related purchases, expanded rewards categories, dedicated customer support, and customizable spending limits for employees. By taking advantage of these exclusive benefits, you can enhance your business operations while enjoying the rewards.Southwest Credit Card for Business

Determine Eligibility

To apply for a Southwest credit card for your business, you’ll need to meet certain eligibility requirements. Generally, these include having a registered business entity, a good credit history, and an individual who is authorized to make financial decisions on behalf of the business.

The Ultimate Guide To Delta Airlines Check-In Online

Compare Card Options

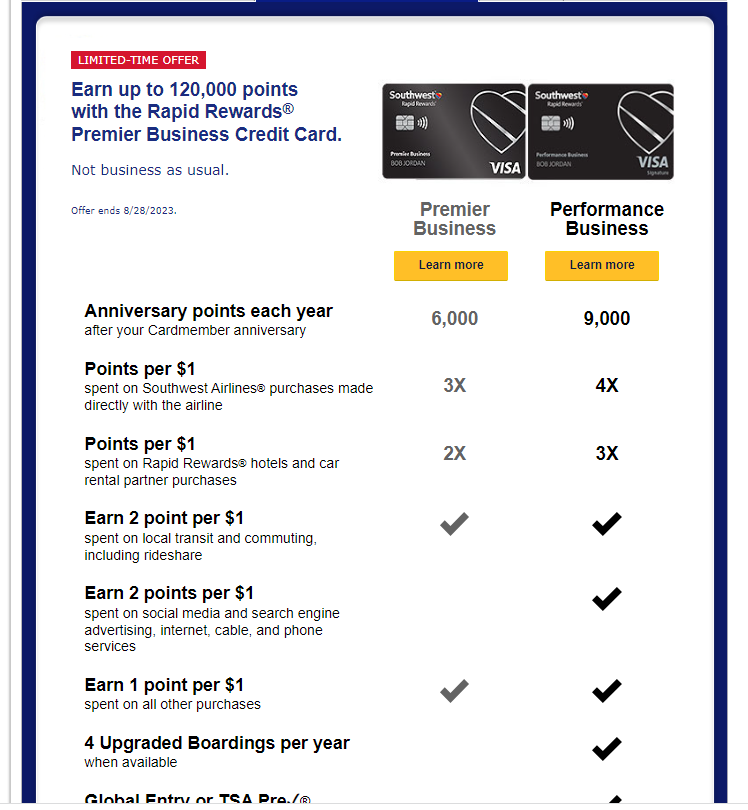

Southwest Airlines offers multiple credit card options tailored for business owners. Compare the available cards based on their annual fees, reward structures, sign-up bonuses, and other features. Consider factors like your business’s spending habits and travel needs to select the card that best aligns with your requirements. Southwest Credit Card for Business

Gather Required Information

When applying for a Southwest credit card for your business, you’ll need to provide specific information during the application process. Gather the following documents and details beforehand.

- Business information: Legal business name, address, contact details, tax identification number (EIN or SSN), and ownership details.

- Personal information: Name, address, contact details, social security number (SSN), and personal financial information.

- Financial details: Annual business revenue, estimated monthly expenses, and any other relevant financial information.

How to Apply for a Southwest Credit Card for Business

Step 1: Research Southwest Business Credit Cards

Before applying for a Southwest business credit card, it’s essential to research and compare the available options. Southwest offers multiple credit cards for businesses, each with its own unique features and rewards structure. Take the time to evaluate the benefits, annual fees, interest rates, and eligibility criteria of each card. By choosing the card that aligns best with your business needs, you can maximize the value you receive.

Step 2: Gather Required Information

To streamline the application process, gather all the necessary information beforehand. You will typically need to provide details such as your business’s legal name, contact information, tax identification number, annual revenue, and years in operation. Additionally, you may be asked to provide personal information about yourself as the business owner, including your Social Security number and financial history. Having this information readily available will make the application process more efficient.

Step 3: Complete the Online Application

Once you have selected the most suitable Southwest business credit card and gathered the required information, it’s time to fill out the online application. Visit the official Southwest credit card website and navigate to the business credit card section. Locate the application form and enter the requested details accurately and completely. Take your time to review the application before submitting it to ensure all information is correct.

Step 4: Await the Decision

After submitting your application, the credit card issuer will review your request and evaluate your eligibility. This process may take a few business days. During this time, it’s crucial to be patient and avoid applying for multiple credit cards simultaneously, as it can negatively impact your credit score. Once the issuer has made a decision, you will be notified via email or mail regarding the status of your application.

Step 5: Activate and Utilize Your Card

Congratulations! Upon approval, you will receive your Southwest business credit card in the mail. Follow the activation instructions provided with the card to activate it successfully. Once activated, you can begin using your card for business expenses and start earning valuable rewards and benefits. Remember to use your card responsibly and make timely payments to maintain a good credit history.

Conclusion

Southwest Credit Card for Business: Obtaining a Southwest credit card for your business can be a game-changer, allowing you to earn rewards, enjoy exclusive benefits, and save on travel expenses. By following the steps outlined in this guide, you can navigate the application process with confidence. Southwest Credit Card for Business

Remember to choose the right card for your business, gather the necessary information, complete the online application accurately, and patiently await the issuer’s decision. Once approved, activate your card and start reaping the rewards. With a Southwest credit card for business in your wallet, you’ll be well on your way to maximizing your business’s potential and achieving your travel goals.

Applying for a Southwest credit card for your business is a smart move if you frequently travel with Southwest Airlines. By understanding the benefits, eligibility requirements, and following the application process carefully, you can increase your chances of obtaining a Southwest credit card tailored to your business needs. Maximize the rewards and perks offered by the card and enjoy the convenience and savings it brings to your business travel. Southwest Credit Card for Business